Data and AI will make or break personalization in banking

NOV. 6, 2025

5 Min Read

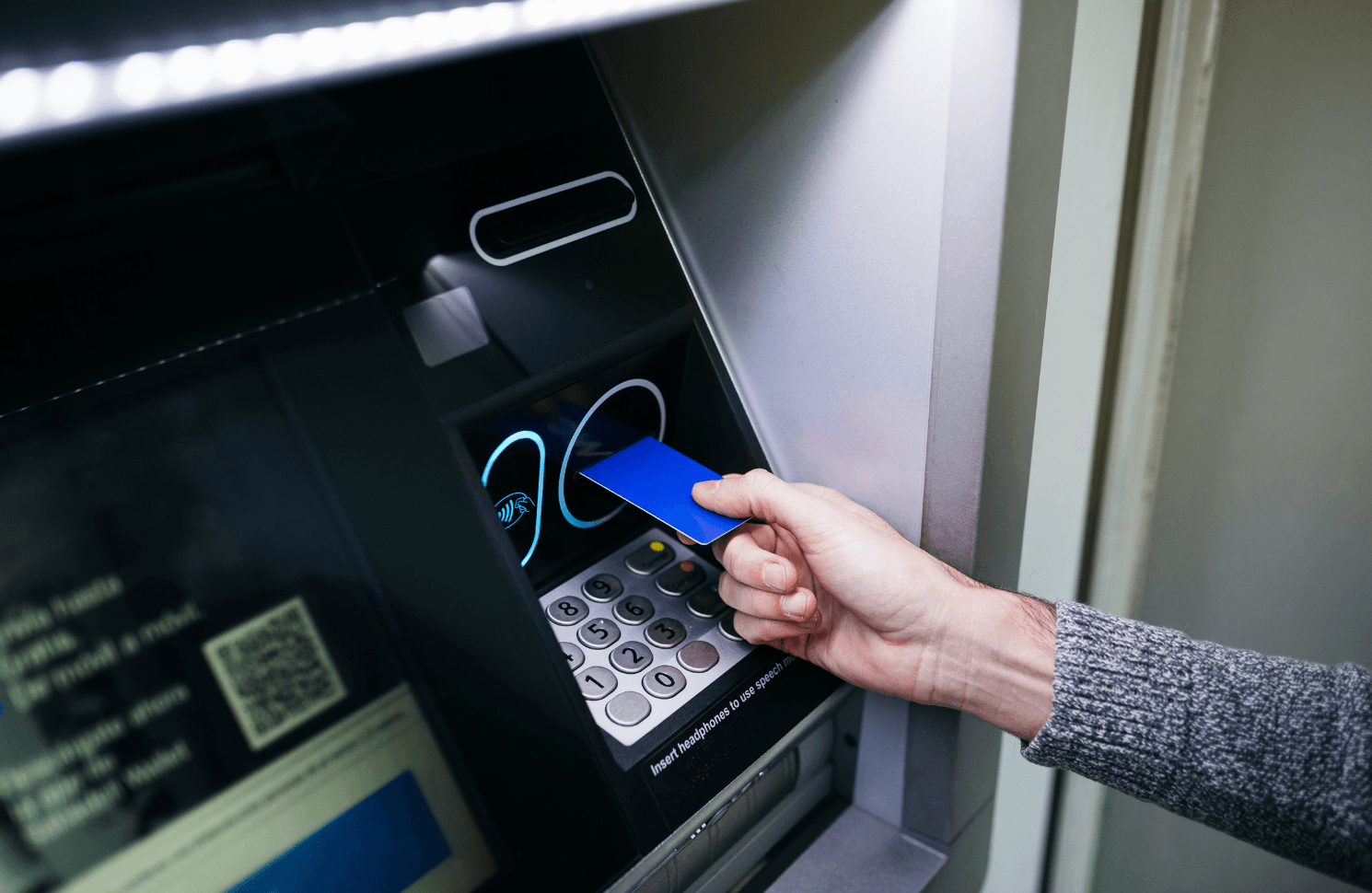

Personalizing each customer’s experience is now central to loyalty and growth in retail banking.

Banks can no longer treat every customer the same—84% of banking customers would consider switching to a competitor for more personalized financial guidance. Digital transformation in the banking industry has raised the bar, as customers accustomed to tailored services from tech giants now expect the same level of individualized attention from their banks.

For banks, personalization has shifted from a one-off tactic to a strategic mandate. Industry leaders weave data analytics and AI into daily operations to tailor services in real time, aligning modern technology with a customer-first mindset. This enterprise approach breaks down silos between business and IT, enabling a unified view of the customer. Banks that succeed in embedding personalization into every process earn deeper loyalty and higher lifetime value, while those stuck in one-size-fits-all methods quickly fall behind.

key-takeaways

- 1. One-size-fits-all banking experiences are no longer viable as customers expect tailored guidance, timely offers, and consistent treatment across every channel.

- 2. Siloed data, legacy platforms, and strict regulatory requirements are the primary barriers that keep banks from turning personalization into a repeatable capability.

- 3. Modern data platforms and AI models allow banks to build a unified customer view and deliver real-time recommendations that feel relevant across digital and human touchpoints.

- 4. Enterprise-level personalization strategy, backed by clear metrics and executive sponsorship, shifts focus from short-term campaigns to long-term gains in loyalty, product adoption, and margin.

- 5. Banks that invest in personalization as a strategic discipline improve speed to value, reduce wasted spend, and create measurable impact on revenue, retention, and cost efficiency.

The new mandate for personalized banking experiences

Personalization has become a core requirement in retail banking. Customers now judge their bank against the hyper-tailored experiences they get from digital services like streaming platforms and online retailers. They expect proactive recommendations and support tailored to their unique needs, rather than generic mass offers. This shift is a direct result of digital transformation in banking services rewriting expectations: fintech startups and neobanks use data-driven personalization as a differentiator from day one. In response, forward-looking banks recognize that offering one-size-fits-all service isn’t just outdated – it’s a risk to customer retention and growth.

The pressure to personalize goes beyond customer expectations. New digital entrants are raising the bar by delivering context-aware financial advice and bespoke products via mobile apps and AI-powered tools. Traditional banks, often slowed by legacy systems, feel the impact when tech-savvy consumers gravitate toward more personalized options. On the upside, banks that embrace this mandate stand to strengthen customer loyalty and stay ahead of the curve. By making every interaction relevant and timely, they can position themselves not just as transaction processors but as trusted advisors integral to their customers’ financial lives.

"Banks that succeed in embedding personalization into every process earn deeper loyalty and higher lifetime value, while those stuck in one-size-fits-all methods quickly fall behind."

The challenges of personalization in retail banking

Many banks struggle to personalize services due to internal and external hurdles. These challenges create a gap between what customers expect and what institutions can deliver. Below are some of the critical obstacles holding banks back from true one-to-one personalization:

Siloed data and fragmented customer views

Retail banks often store customer data in separate product, channel, or departmental systems that don’t communicate with each other. This siloed data environment prevents a holistic view of each customer, making it difficult to generate the insights needed for truly personalized offers. The result is often generic communications that fail to reflect a customer’s full financial picture.

Legacy systems limiting agility

Many banks still run on legacy systems not built for real-time analytics or omni-channel engagement, which makes adding modern personalization tools slow and costly. These technology roadblocks mean banks cannot innovate at the pace of customer expectations.

Regulatory and data privacy constraints

Strict banking regulations pose a challenge to personalization. Banks must navigate privacy laws and compliance rules (for example, GDPR and other data protection mandates) when using customer data. Banks often become overly cautious with data to avoid penalties, which can slow down initiatives to share data internally or apply AI models. While protecting customer information is essential, these constraints can make it harder to deliver tailored experiences seamlessly.

Fintech competition raising customer expectations

Digital-native fintech companies and challenger banks are setting a high bar for personalized service. They leverage modern cloud platforms and agile development to roll out tailored products and features quickly. As a result, consumers now expect the same personalization from traditional banks, and failing to meet that expectation isn’t just a missed opportunity – it’s a recipe for customer churn.

All these factors contribute to a personalization gap in the industry. The end result is often a disjointed, one-size-fits-all experience that leaves customers underwhelmed. It’s telling that only 21% of banking customers are fully satisfied with their bank’s personalization efforts today. The good news is that banks can turn this challenge into an opportunity. By addressing data silos, modernizing systems, and rethinking processes, even longstanding institutions can begin delivering the tailored experiences their customers crave.

The business benefits of personalized banking experiences

When done right, personalization pays off for both customers and the bank’s bottom line. The advantages go far beyond marketing—they translate into measurable gains in growth and efficiency. In fact, banks that excel at personalization can significantly improve financial performance: hyper-personalization has been shown to reduce customer acquisition costs by up to 50% while increasing revenues by 5–15%. Below are several major benefits a personalized banking strategy can deliver:

- Higher customer loyalty and retention: Tailored experiences make customers feel understood and valued, boosting loyalty and reducing churn risk.

- Greater customer lifetime value: Satisfied customers tend to use more products and services over time, boosting their overall lifetime value to the bank.

- Improved cross-selling and upselling: When offers and recommendations align with individual needs, customers are far more likely to adopt additional products or upgrades, directly driving revenue growth.

- Lower customer acquisition costs: Personalized outreach means marketing resources target the right customers with relevant offers, making campaigns more efficient and lowering the cost to acquire each new customer.

- Operational efficiency gains: Focusing on each customer’s relevant needs eliminates wasted effort and redundant communications. Banks can streamline support and marketing, directing resources where they have the most impact.

- Stronger ROI on digital transformation: Investments in analytics, AI, and digital channels yield higher returns when used to deliver experiences that customers respond to. Personalization ensures digital transformation initiatives translate into tangible outcomes like higher product uptake and lower attrition.

Personalization isn’t just about making customers happy—it directly drives business performance. Banks that systematically personalize services see more engagement and higher sales per customer, all while spending less on blanket promotions that don’t resonate. As customer relationships deepen, improvements in experience translate into quantifiable results. In short, a personalized approach boosts both the top line (through growth and loyalty) and the bottom line (through efficiency and retention).

Integrating data and AI for real-time personalization

Achieving true one-to-one service requires a technology foundation built around the customer. The first step is breaking down data silos by consolidating information into a single, 360-degree customer view. Banks are adopting modern, cloud-based data platforms to integrate data from core banking systems, mobile apps, CRM tools, and more into one source of truth. This unified data foundation, reinforced by strong data governance, provides the necessary base for personalization. With clean, comprehensive data in hand, banks can begin to understand each customer’s behaviors, preferences, and needs on a granular level.

The next step is turning these insights into action through advanced analytics and AI. Machine learning models can analyze transaction patterns and lifestyle cues to predict what a customer might need next, such as a tailored savings plan or a pre-approved loan offer. AI-powered decision engines now enable real-time personalization, meaning the bank can respond instantly when a customer takes an action. If they are browsing mortgage rates, the bank’s website can proactively offer a customized home loan quote on the spot. Importantly, these AI-driven interactions are delivered consistently across channels (mobile, web, branch, or contact center) so that customers receive a cohesive experience. By embedding intelligence into every touchpoint, banks can personalize each interaction at scale without losing the human touch—frontline staff are empowered with data-driven recommendations, and digital channels feel more like a personal advisor than a generic portal.

Crucially, this data-driven approach must be underpinned by rigorous security and transparency so that customers trust the personalized services. When implemented thoughtfully, integrating data and AI enables even large banks to behave like a familiar local banker who knows each customer well, while leveraging the speed and efficiency of modern technology.

Making personalization an enterprise strategy

To truly reap the benefits, banks must approach personalization as a company-wide strategy rather than a series of ad-hoc projects. This means aligning every department, from marketing and product design to IT and compliance, around a shared vision of customer-centric service. Strong executive sponsorship is critical: leadership should champion personalization as a strategic priority and set clear goals (like improving customer lifetime value or digital adoption rates) that resonate across the organization. When IT and business units work in tandem, personalization becomes embedded into the bank’s DNA instead of confined to a single team or campaign.

Making personalization an enterprise strategy also requires cultural change and new ways of measuring success. Banks should cultivate a data-driven, customer-first mindset at all levels. Key performance indicators should evolve beyond short-term product sales to include metrics like customer satisfaction scores, retention rates, and share of wallet gained. Institutionalizing personalization and tracking its impact holistically creates a continuous feedback loop: successes can be scaled up, and lessons learned can refine the approach over time. Ultimately, making personalization a core business strategy aligns the organization toward better customer experiences and sustainable growth.

"Strong executive sponsorship is critical: leadership should champion personalization as a strategic priority and set clear goals that resonate across the organization."

Personalizing customer experience in retail banking with Lumenalta

Building on this enterprise-wide approach, Lumenalta partners with banks to turn personalization strategy into measurable outcomes. We bring deep expertise in data, AI, and cloud modernization to help break down silos and integrate personalization across every channel. Our team works as a co-creation partner alongside bank leadership, aligning technology solutions with business objectives, regulatory requirements, and a customer-first mindset. The focus is always on tangible results: faster time-to-market for new personalized services, increased customer engagement, and clear ROI on digital transformation investments.

In practice, we help retail banks implement the architectures and operating models needed for personalization at scale. That can include building unified customer data platforms, deploying real-time analytics and AI-driven recommendation engines, and equipping front-line teams with intuitive tools that surface insights at the right moment. Throughout these initiatives, we emphasize governance and security so that innovation doesn’t introduce undue risk. We accelerate execution while carefully managing change, enabling traditional banks to deliver modern, personalized experiences with confidence. The end goal is a banking organization that treats personalization not as a one-off project but as a core competency that drives lasting customer loyalty and growth.

table-of-contents

- The new mandate for personalized banking experiences

- The challenges of personalization in retail banking

- The business benefits of personalized banking experiences

- Integrating data and AI for real-time personalization

- Making personalization an enterprise strategy

- Personalizing customer experience in retail banking with Lumenalta

- Common questions about digital transformation in banking

Common questions about digital transformation in banking

How does digital transformation work in banking?

How is digital transformation reshaping the banking industry?

How is digital transformation changing banking services?

What are the digital transformation trends in banking?

How is the banking sector undergoing digital transformation?

Want to learn how digital transformation can bring more transparency and trust to your operations?