Scale with data precision

The tactical playbook private equity CIOs need to clean up data without overhauling systems

Key execution findings

Manual reconciliation across fund, deal, and portfolio systems steals days and erodes trust. You don’t need a rip-and-replace; you need a phased plan that fixes the data where value leaks. This tactical playbook maps each move to KPIs like close time, reconciliation effort, and LP response speed—so finance sees gains in weeks, not years. The result is cleaner data, faster cycles, and a control environment auditors and investors trust.

59%

of organizations don’t measure data quality—blind to the cost of bad data.*

68%

of PE managers report deal delays of 3+ months, stretching decision cycles.*

$12T

private-equity AUM forecast within the decade, raising the bar on reporting.*

135,200 hours

saved over three years in a TEI case when consolidating data and tools.*

SEP. 4, 2025

3 Min Read

This playbook lays out a phased, outcome-first path: clean up feeds, standardize definitions, centralize truth, and automate filings. Each phase declares a KPI, owner, and date—reducing close time, raising data trust, and speeding LP responses. You get a resilient, auditable foundation that scales with AUM growth and withstands diligence.

Why modernization matters now

PE teams still reconcile across bespoke sheets and portals, delaying closes and LP answers. Many firms don’t even measure data quality, masking the true cost of errors. Meanwhile, private markets continue to expand, and committees expect tighter, faster reporting. The operational tax of manual roll-ups is no longer defensible.

How to execute without disruption

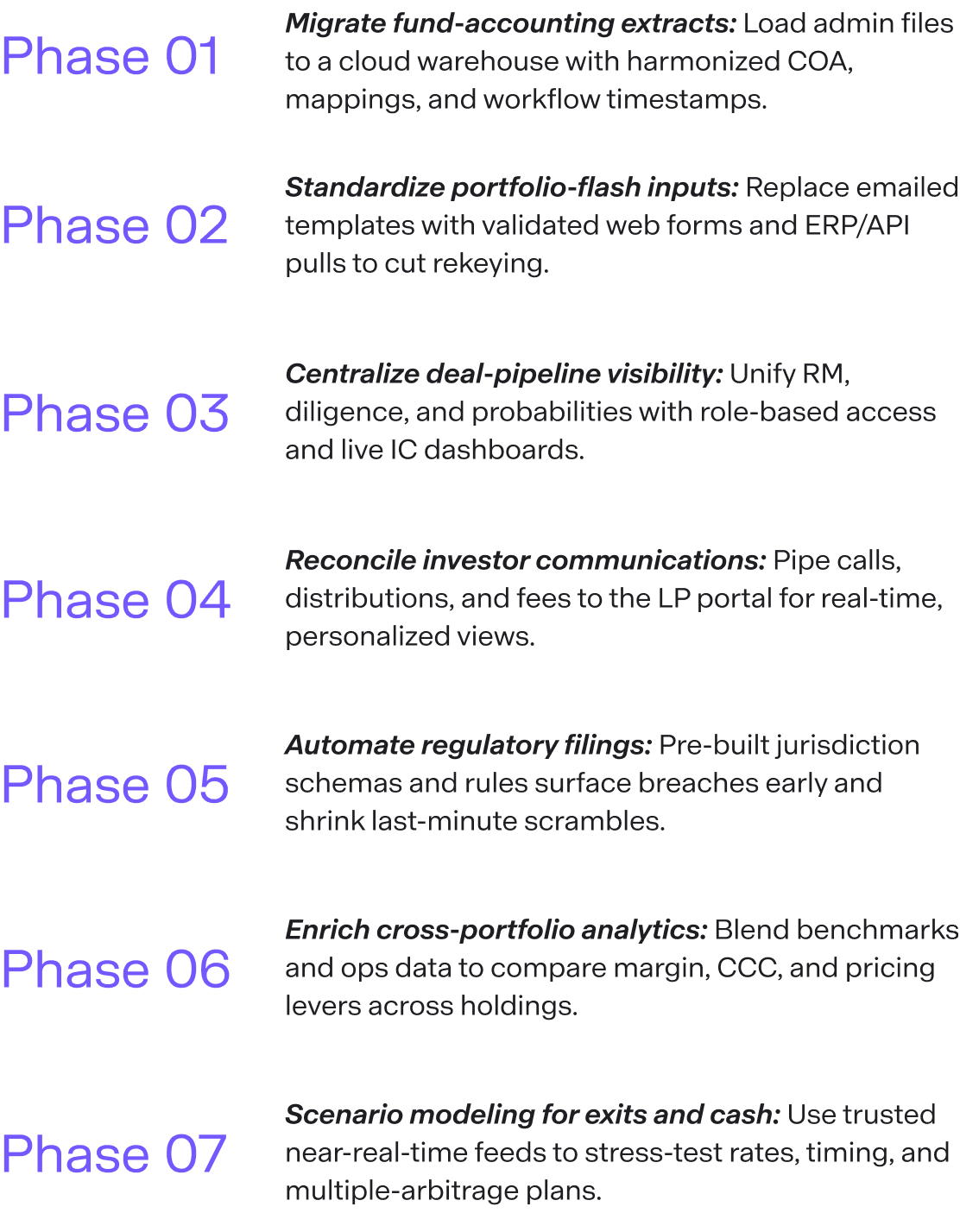

Start where value leaks are largest. Phase 1 ingests administrator extracts into a governed warehouse with harmonized charts. Phase 2 standardizes portfolio flash via validated forms and APIs to stop rekeying at the source. Phase 3 centralizes deal pipeline so finance and compliance see changes instantly. Phase 4 connects the warehouse to the LP portal for accurate, on-demand statements. Phases 5–7 automate filings, layer cross-portfolio analytics, and introduce scenario modeling. Each phase defines a KPI—days to close, hours saved, LP turnaround—and proves it before moving on.

What results to expect

Expect fewer manual journal entries, faster month-end, and consistent IC materials. LP inquiries drop as portals reflect current calls and distributions. Compliance risks fall as filings run from standardized schemas with audit trails. Teams reallocate time from stitching to analysis, and leadership gains a single source of truth that scales with AUM. In short: cleaner data, quicker cycles, stronger trust—without an overhaul.

*based on external research sources cited within.

Access the playbook CIOs use to modernize private equity data

Need an executive summary? View our roadmap for data modernization in private equity.

FAQs

How can I modernize data workflows without interrupting fund cycles?

What are the key KPIs I should track for private equity data modernization?

Where should I begin if my private equity firm has highly fragmented reporting systems?

What kind of governance structure is needed to support ongoing data quality?

How can I get cross-functional teams to agree on shared metrics and data definitions?

Take the brighter path to software development.