Turn compliance into a strategic advantage

OCT. 9, 2025

6 Min Read

Strict regulations and outdated systems might seem like they’re pumping the brakes on your digital investment platform, but compliance can actually become a catalyst for innovation when it’s woven in from the start.

For financial institutions, this burden is very real; 98% of financial institutions saw their financial crime compliance costs rise to $61 billion in the U.S. and Canada in 2023. Instead of treating compliance as an afterthought, CIOs and CTOs are embedding regulatory requirements and data governance directly into their technology strategy. By modernizing legacy platforms and embedding compliance checks into development workflows, they turn meeting regulations into a routine part of operations rather than a last-minute hurdle. This proactive approach accelerates time to market for new services, cuts down audit and reporting overhead, and reduces risk; all while protecting customer trust and freeing teams to focus on growth.

key-takeaways

- 1. Compliance becomes an engine for sustainable growth when embedded into platform design, allowing faster scaling and innovation without regulatory setbacks.

- 2. Modernizing legacy systems and adopting compliance-as-code eliminate manual reporting bottlenecks and accelerate time to market for digital investment platforms.

- 3. Strong data governance strategies improve data quality, streamline audits, and make regulatory reporting consistent across all systems.

- 4. Treating compliance as a built-in design principle reduces audit overhead, increases confidence in scaling, and protects customer trust.

- 5. Technology leaders who view compliance as a growth accelerator can innovate confidently while maintaining regulatory strength and operational efficiency.

Legacy systems block both compliance and scale

Legacy core systems and manual processes create hidden roadblocks under strict regulatory oversight. Outdated platforms often trap data in silos, forcing teams to stitch together reports from multiple systems manually. This fragmentation increases the chance of errors and means every audit becomes a fire drill, as staff scramble to gather information from disparate databases. As compliance requirements pile up, legacy infrastructure that wasn’t built for modern data demands simply cannot keep up.

These limitations directly impede growth. When your back-end is a patchwork of aging technologies, launching a new digital investment product or scaling to more users requires costly workarounds and extra compliance steps. Over half of financial institutions running legacy cores report they struggle to scale their operations due to data silos and production bottlenecks. It’s a one-two punch: legacy systems slow down innovation at the exact moment regulators are demanding more transparency. The result is delays in rolling out services, ballooning costs for compliance projects, and a reluctance to push boundaries due to compliance risks.

"CIOs and CTOs are embedding regulatory requirements and data governance directly into their technology strategy."

Compliance as code means scaling with confidence

One key to reconciling rapid growth with heavy compliance demands is adopting “compliance as code.” This approach means encoding regulatory policies and security controls directly into the software development lifecycle. Instead of separate manual reviews at the end of a project, automated checks ensure each code commit and infrastructure change is compliant from the outset. For example, new features can have their regulatory requirements defined as testable code and automatically validated in the CI/CD pipeline. Compliance isn’t a standalone task anymore — it becomes a built-in feature of the development process, so teams can deploy updates quickly without fear of violating regulations.

For technology leaders, treating compliance as code fundamentally boosts confidence in scaling up services. Deployments no longer pause for lengthy audit preparations because evidence of compliance (encryption settings, access logs, data retention configurations, and so on) is gathered automatically along the way. This proactive integration prevents last-minute surprises while slashing the costs associated with audits. In fact, automating compliance controls can make audit processes about 60% less expensive than traditional manual efforts. Equally important, teams are freed from manual compliance chores and can focus on innovation – accelerating the delivery of business value while staying secure and within regulatory guardrails.

Effective data governance strategies underpin safe growth

Growth and compliance both depend on a solid foundation of trusted data. Effective data governance provides the structure and oversight needed to manage information at scale without stepping into regulatory pitfalls. By establishing clear rules and ownership for enterprise data, CIOs ensure that everything from customer records to transaction logs is accurate, secure, and accessible to those who need it. Robust governance not only streamlines regulatory reporting but also improves decision-making, since teams can confidently use high-quality data to drive new initiatives.

- Inventory and classify data: Maintain a detailed catalog of all data assets (e.g., customer records, transactions) and label each by sensitivity or regulatory requirements.

- Establish data ownership: Assign responsibility for key data domains to specific owners or stewards who will uphold quality and compliance for those datasets.

- Unify and integrate systems: Break down silos by consolidating information into a central repository or through standardized integrations, ensuring everyone uses a single source of truth.

- Ensure data quality: Implement automated validation and cleaning processes to keep information accurate, consistent, and reliable for reporting and analysis.

- Enforce access controls and privacy: Use role-based access management and encryption to protect sensitive information and meet privacy laws (such as GDPR or HIPAA).

- Enable continuous monitoring: Track data usage and changes with audit trails and alerts, making it easier to detect anomalies and prove compliance during inspections.

Regular monitoring and audits of data usage will further ensure that any issues are caught early. In fact, organizations with mature data governance have seen a 57% improvement in data analytics and a 55% boost in overall data quality. Altogether, these practices create a trustworthy data environment that supports both compliance and business growth. When data is well-organized and trustworthy, meeting compliance requirements becomes a far smoother process. Teams spend less time chasing down errors and more time applying insights to grow the business. In short, a strong data foundation allows new products and services to launch faster, with compliance built into the environment from day one.

"Effective data governance provides the structure and oversight needed to manage information at scale without stepping into regulatory pitfalls."

From compliance burden to growth accelerator

For organizations used to last-minute scrambling, compliance often feels like a burden that slows everything down. With the right approach, however, it can become an engine for growth. The difference between treating compliance as an afterthought and building it into the platform from day one is clear in several areas:

| Compliance as Burden (Legacy) | Compliance as Accelerator (Modern) |

|---|---|

| Manual, ad-hoc compliance checks after development | Automated compliance checks embedded throughout development |

| Fragmented data in silos, inconsistent reports | Unified data platform ensures consistent, accurate reporting |

| Repeated scramble for audit evidence, high labor costs | Continuous evidence collection, far less audit prep effort |

| Reactive responses to new regulations (last-minute fixes) | Proactive policy-as-code updates keep systems continuously compliant |

| Slow to launch new features due to lengthy approvals | Rapid deployment of new services with built-in controls, faster time to market |

For CIOs and CTOs, shifting from the left column to the right column is a game-changer. By treating regulatory requirements as core design principles rather than external hurdles, leaders gain a new level of agility. Compliance becomes not just a legal necessity but a strategic asset that builds trust and competitive advantage. When regulators see a proactive approach and systems are built to adapt, your team can pursue innovation confidently without always looking over their shoulder.

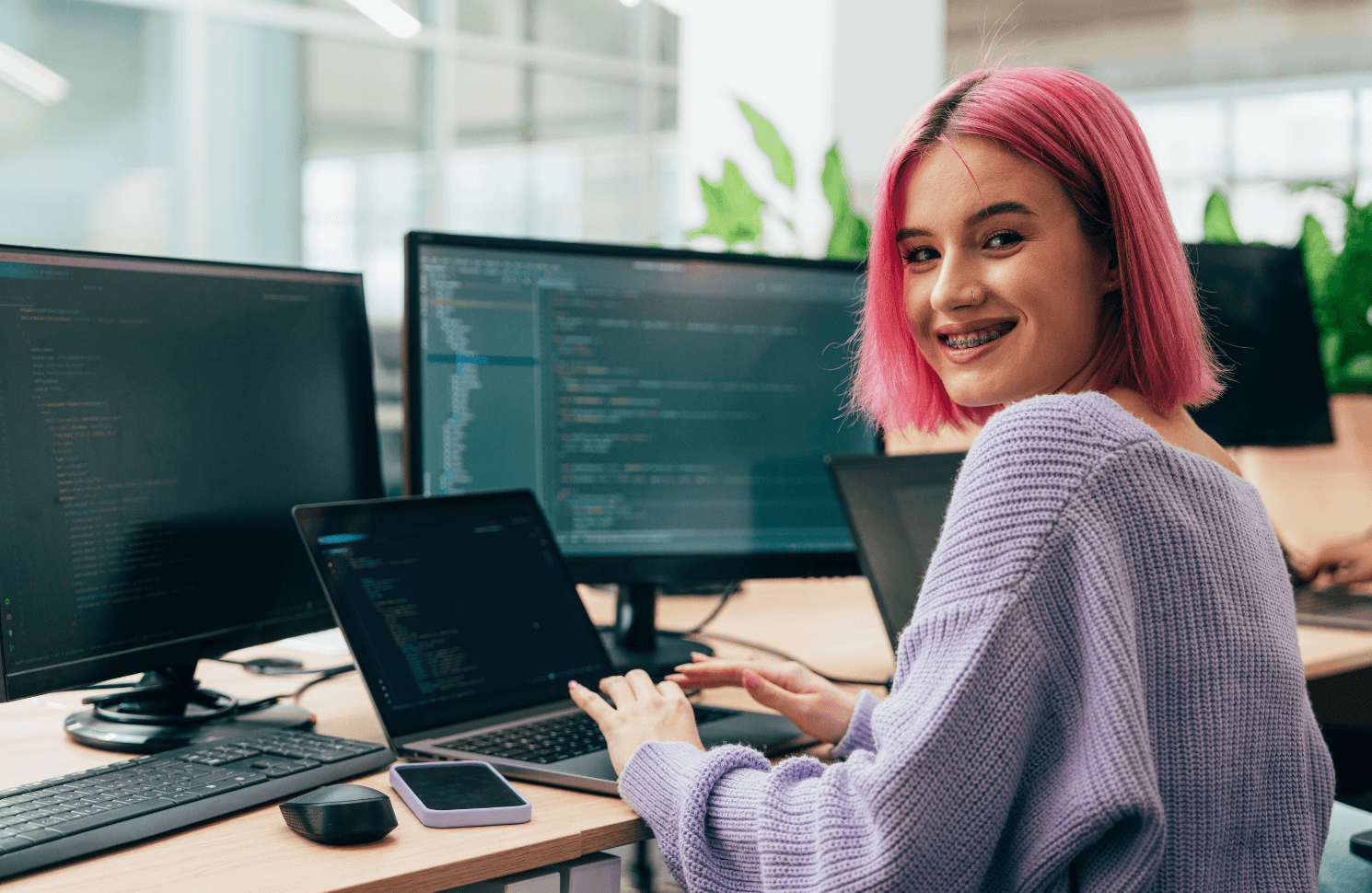

Compliance-driven growth with Lumenalta

Extending the idea of turning compliance from a burden into a growth driver, Lumenalta partners with CIOs and CTOs to embed governance into every layer of a platform from the start. We act as an extension of your IT team, modernizing legacy systems into agile, cloud-ready platforms. We also weave automated controls throughout development and operations. With compliance built into design and development pipelines, this approach eliminates last-minute fire drills and maintains a continuous compliance posture. That means new digital services launch on a secure foundation, with regulatory requirements part of the platform’s DNA rather than an afterthought.

From a business perspective, a compliance-by-design philosophy dramatically reduces audit overhead and strengthens trust with both regulators and customers. CIOs and CTOs can pursue ambitious growth knowing that governance and security are built in, leading to fewer surprises and smoother approvals for new initiatives. With technology acting as a true business accelerator, every compliance investment pays dividends in agility and confidence. Partnering with an experienced team in this way ensures that IT leaders meet today’s rules and stay prepared for tomorrow’s changes. Crucially, this approach delivers measurable value to the business at every step.

table-of-contents

Common questions about legacy system modernization

How can digital investment platforms manage compliance while scaling?

What are effective data governance strategies for regulated platforms?

What is compliance as code and why is it important?

Why do legacy systems hinder compliance and growth?

How can CIOs and CTOs future-proof compliance as regulations shift?

Want to learn how legacy system modernization can bring more transparency and trust to your operations?