Masterworks democratizes modern art with full-stack innovation and real-time data

Regulated art investment platform scales past 1M subscribers with full-stack modernization

About

Masterworks is a pioneering platform that democratizes fine art investment by enabling users to buy and trade shares in museum-quality, blue-chip artworks. Their tech-enabled investment platform empowers everyday investors to access blue-chip art markets with seamless digital experiences, real-time data, and secure, scalable infrastructure.

1M+

subscribers

35%

increase in mobile transactions

5K

mobile transactions in a single month thanks to Trading and Portfolio features

Challenge

By enabling fractional ownership of blue-chip artworks, the company has opened an elite asset class to a wider public. But with this ambitious model came a set of equally complex technical challenges: rapid scaling, strict regulatory compliance, evolving mobile expectations, and a growing demand for real-time, data-driven user experiences.

To maintain its momentum as a market leader, Masterworks needed a technology partner capable of delivering speed and scale without compromising quality. From rebuilding unstable mobile systems to modernizing its backend architecture and extending investor-facing web functionality, the engagement required a team that could embed seamlessly, work iteratively, and align tightly with both product and regulatory needs.

“Lumenalta understood the top-of-funnel, early stage we were at,” says Alberto Simon, Head of Product & Co-founder. “Their team was truly ready for that, and their engineers worked directly with us to take on full ownership.”

Solution

Lumenalta partnered with Masterworks across three core areas: web applications, mobile apps, and data infrastructure. This full-stack collaboration provided a foundation for long-term scalability, product evolution, and a secure, high-performance user experience across channels.

Web platform enhancements: Scaling the investor experience

For the web applications, we were tasked with extending Masterworks’ main investor platform and internal admin tools—both built on Node.js and MariaDB with React-powered interfaces, hosted on AWS. The investor-facing system required robust trading and portfolio features that complied with strict securities laws while delivering a seamless user experience.

We delivered and continue to evolve key capabilities:

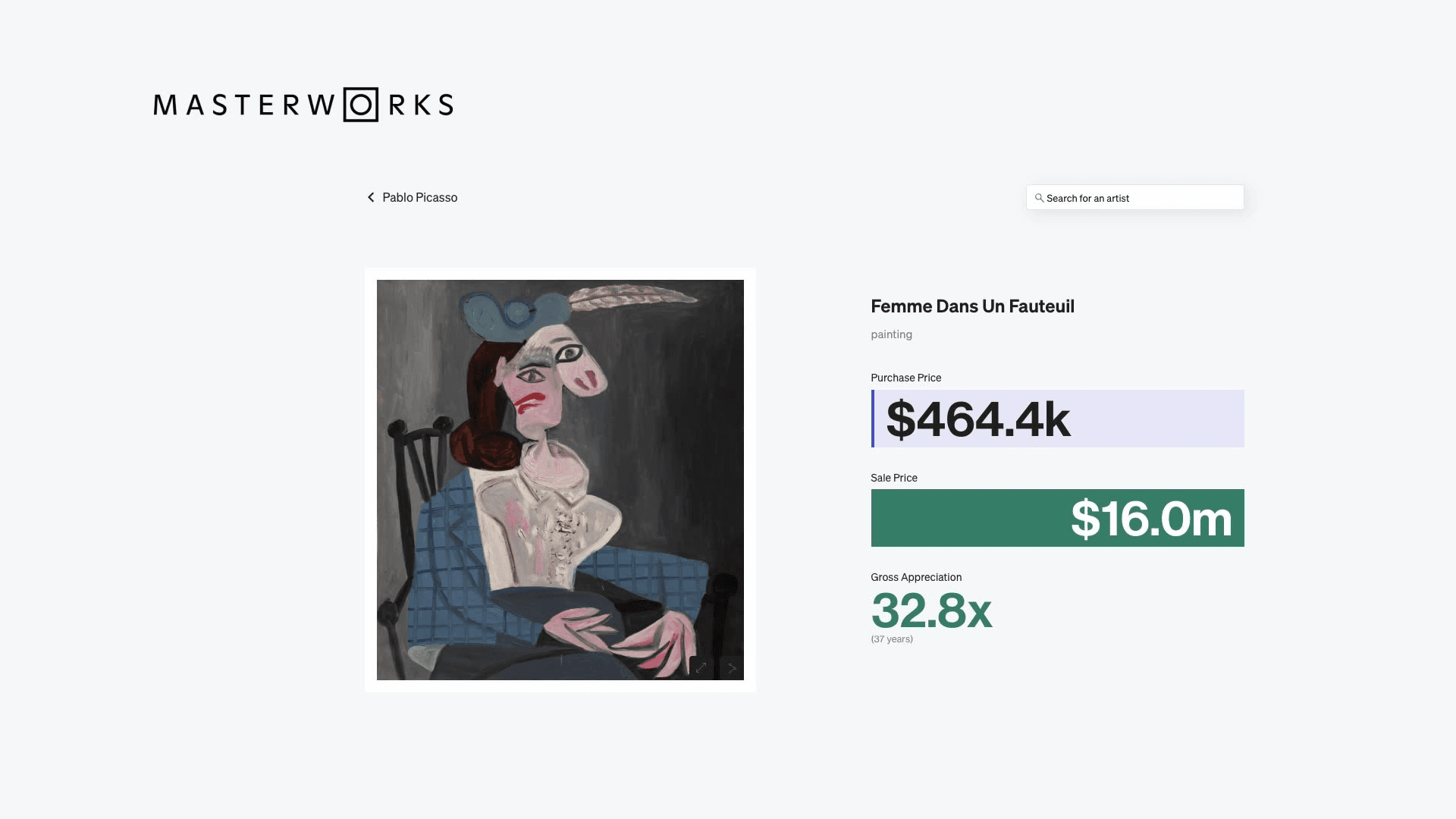

- A trading market that allows users to buy and sell shares of fine art on a secondary market, prior to full artwork sales—enhancing liquidity while meeting regulatory constraints.

- A real-time portfolio experience, providing users with visibility into their holdings, transaction history, and performance trends.

- Enhanced backend workflows and modular feature deployments that support continued scalability and compliance-readiness.

- Ongoing backend evolution, including geospatial visualization of artwork locations, trading system migration, and expanded data support.

Our team embedded within Masterworks’ agile squads, contributing to rapid iteration cycles without disrupting live systems. This close collaboration enabled swift pivots based on experimental outcomes, a necessity in Masterworks’ test-and-learn culture.

Mobile transformation: Rebuilding for performance and engagement

The original mobile app suffered from performance issues, instability, and slow load times, undermining user trust and dampening engagement. We began with a full technical audit, uncovering deep architectural flaws.

To remedy this, we:

- Migrated the codebase from JavaScript to TypeScript, enabling stricter typing, improved developer productivity, and fewer runtime errors.

- Overhauled the UI layer using react-native-reanimated, drastically improving performance and eliminating glitchy animations.

- Introduced robust biometric authentication (including facial recognition) to align with modern fintech standards and strengthen user trust.

- Implemented Sentry for real-time error logging, accelerating issue resolution.

- Built a scalable push notification system capable of delivering over 50,000 messages simultaneously, enabling rapid communication during launches and events.

- Began integrating AI systems to analyze user behavior and optimize communications in real-time, laying the foundation for hyper-personalized engagement.

To further streamline development, we initiated a migration from React Native CLI to Expo, reducing overhead and simplifying store submissions.

These improvements led to dramatic increases in user satisfaction and engagement, while positioning the mobile app as a core channel for both transactions and communications.

Data infrastructure overhaul: Building a scalable backbone

The third pillar of our engagement addressed Masterworks’ rapidly growing data needs. As usage intensified, the platform’s core databases experienced concurrency issues and frequent strain. Compounding the problem, internal business teams relied heavily on production systems for real-time dashboarding, which added even more load.

We approached this challenge by:

- Implementing real-time performance monitoring to pinpoint slow queries and system bottlenecks.

- Building a new caching layer to decouple reporting from the primary database, improving response times while preserving data accuracy.

- Leveraging tools like Apache Airflow and Luigi to automate daily ETL processes, ensuring data freshness across operational dashboards.

- Introducing task schedulers and modular data pipelines that flexibly scale based on traffic and business priorities.

- Educating internal teams on responsible data usage, reducing avoidable stress on production environments.

Together, these systems transformed Masterworks’ data infrastructure from a fragile bottleneck into a reliable growth enabler, giving teams real-time insights while supporting seamless performance on the customer-facing side.

Results

“The outcome is more than just improved speed or security,” says Simon. “It’s a full transformation that reflects the quality and value of the very art we offer. A seamless, elegant, and high-performing platform worthy of its mission to democratize a historically exclusive asset class.”

Growth & user acquisition

- Surpassed 1 million subscribers as of May 2025, fueled by scalable infrastructure and an improved user experience across devices.

- After mobile push notifications were introduced, mobile app interactions increased by 35%.

- With the launch of mobile “Trading” and “Portfolio” features, mobile app downloads surged by over 5,000 in a single month.

- Mobile now accounts for 20% of all investments, marking a 20% increase in transactional activity on mobile.

Platform performance & scalability

- Optimized query strategies and caching mechanisms led to dramatically faster dashboard load times, enhancing decision-making for both users and internal teams.

- Resolved key concurrency issues, allowing multiple users and internal teams to query data simultaneously without conflict or slowdown.

- Reduced AWS infrastructure costs by right-sizing database clusters and eliminating unnecessary overprovisioning.

- The platform now boasts a scalable backend architecture that can adapt to future user growth without major overhauls.

Security & compliance

- Introduced biometric and facial recognition authentication, ensuring strong account protection and aligning with financial regulatory standards.

- Maintained full compliance with securities regulations while supporting real-time trading and fractional ownership capabilities.

- Implemented admin controls and backend safeguards to ensure secure handling of investor data, portfolio information, and transaction history.

Operational agility

- Transitioned from daily manual interventions to automated data workflows, freeing up engineering time for product innovation.

- Empowered internal data and analytics teams with tools and infrastructure that support faster launches of dashboards and insights, enabling the business to stay in lockstep with market dynamics.

- Agile approach enabled rapid feature experimentation and iteration, aligning with Masterworks' fast-paced culture of innovation.

By partnering across the full technology stack, Lumenalta helped Masterworks transform from a fast-moving fintech startup into a scalable, enterprise-grade platform trusted by over a million investors. Each layer of the engagement amplified the others: a modernized backend powered real-time responsiveness, a rebuilt mobile app deepened user engagement, and a reengineered data architecture unlocked the speed and agility needed to stay ahead in a fast-changing market.

Today, Masterworks isn’t just participating in the fine art investment space. They’re redefining access to it.