AUG. 15, 2025

3 Min Read

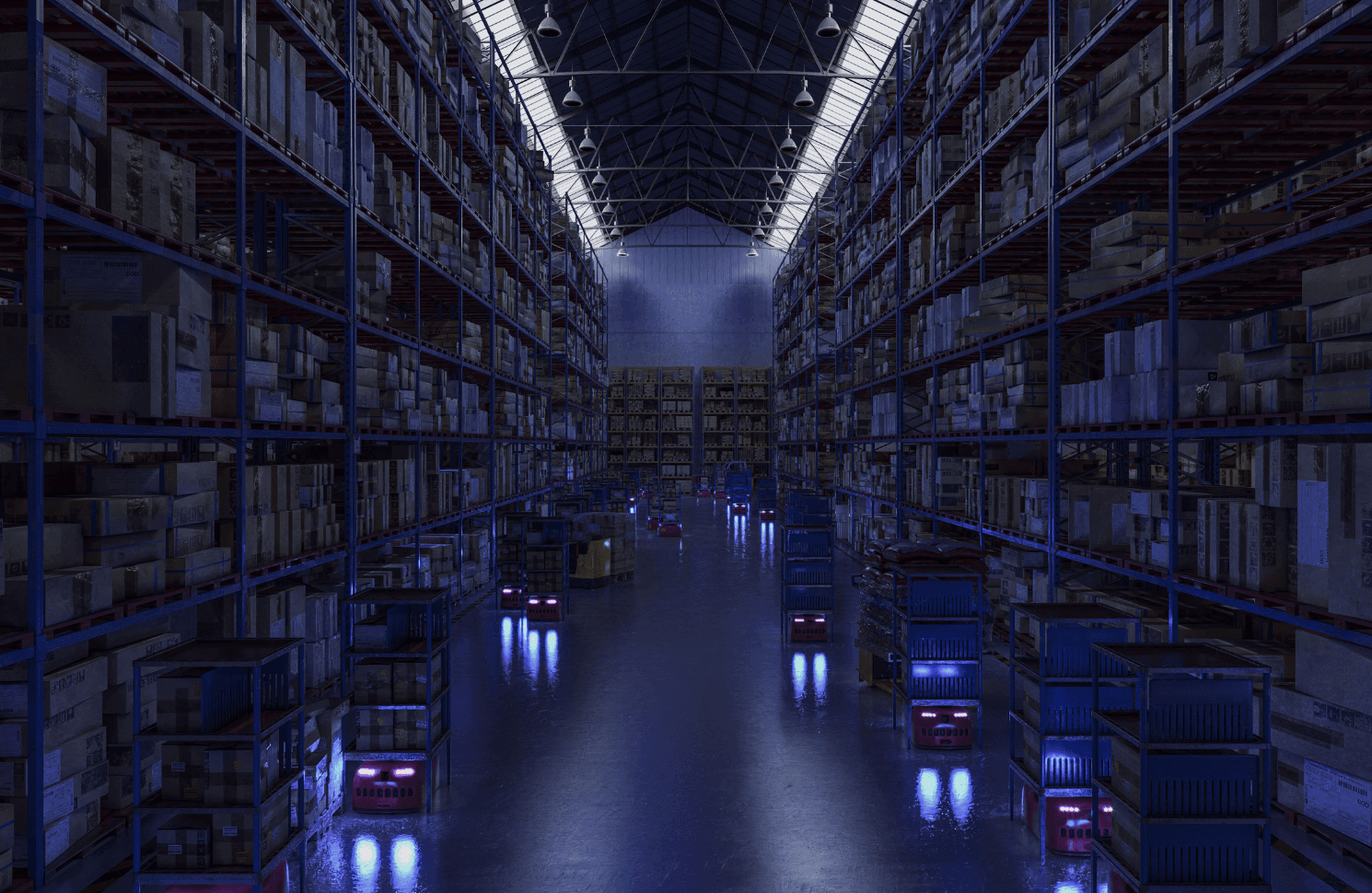

The logistics sector is under pressure to deliver more with less, with shorter delivery windows, tighter margins, and customers expecting complete visibility into their shipments. While AI has been part of the conversation for years, vision-based AI is now emerging as one of the fastest ways to close critical operational gaps. Unlike purely analytical tools, vision AI addresses the physical realities of logistics, from what happens at the dock to the condition of goods in storage, in real time. In this interview, Donovan Crewe, Senior Software Architect at Lumenalta, shares findings from a recent industry survey and explains how organizations are moving from experimentation to measurable outcomes with targeted and high-impact deployments.

1. What’s driving the renewed interest in vision-based AI specifically, rather than broader AI or automation technologies, within the logistics sector today?

The surge in interest comes from the sector’s acute visibility gap. Ninety-four percent of logistics companies still operate “partially blind,” with only 6% claiming complete operational visibility. Broader AI tools like predictive analytics or generative AI offer strategic insights, but vision AI uniquely addresses the physical realities of logistics: what’s happening at the dock, in the aisle, or in the yard right now. By automating what previously relied on human observation, it detects inefficiencies, errors, and risks in real time without requiring a complete systems overhaul. For operators under pressure from rising costs, tighter delivery windows, and competitive advancements, targeted visual monitoring that delivers measurable gains in weeks, not months, makes vision AI an especially attractive starting point

2. The report notes that 58% of vision AI users saw improved efficiency—can you provide concrete examples of how this technology is improving workflows on the warehouse or distribution center floor?

In our study, 57.68% of adopters reported improved operational efficiency, and the impact is very tangible. Vision AI enables automated cycle counting to eliminate manual audits, misplacement detection to prevent costly search time, and dock optimization to measure load accuracy and dwell time in real time. Picking workflows are streamlined by monitoring equipment utilization and optimizing pathing, while quality control improves through automated damage detection, packaging verification, and chain-of-custody validation. These applications reduce wasted labor, cut rework, and give supervisors real-time, data-backed insights that improve both speed and accuracy.

3. With one company saving over $600K annually through damage reduction, how widespread are these kinds of ROI results—and what’s the average payback period companies are seeing after deployment?

The $600K savings example comes from a vehicle logistics firm that used vision AI to document vehicle condition at transfer points, reducing successful damage claims by 40%. While not every deployment delivers six-figure savings, these outcomes are far from rare; 48.19% of vision AI adopters in our survey reported meaningful cost reductions. Importantly, when projects are well-scoped and expert-guided, payback periods are often measured in weeks rather than the months typical of DIY builds.

4. How are early adopters identifying “high-impact” locations to implement vision-based AI, such as loading docks or storage areas, without overhauling their entire logistics systems?

Early adopters typically run a readiness assessment to pinpoint operational bottlenecks, then select a single high-value use case, such as high-error loading docks, high-turnover storage aisles, or inspection stations. Instead of replacing core systems, they integrate vision AI with existing WMS, TMS, and ERP platforms, ensuring the data captured is directly tied to performance KPIs. Most follow a crawl-walk-run model: start with a narrow pilot, expand after proving ROI, then standardize and scale, minimizing disruption and maximizing early wins.

5. For companies with limited internal AI expertise, what practical steps are helping them overcome the 87% skill gap challenge highlighted in the survey? Are vendors playing a greater role in implementation and training?

Absolutely, vendors are stepping in not just as tech providers but as partners in capability building. We’re seeing a lot more pre-packaged solutions that don’t require deep ML knowledge to deploy. APIs and low-code platforms abstract much of the complexity, but most effectively, vendors are offering embedded training during implementation. Smart companies are pairing these vendor-led rollouts with internal champions, often from operations or IT, who can bridge the gap between the tech and real-world usage. The key is starting with clear, narrow use cases and growing from there.

6. How is vision AI being integrated with existing WMS, TMS, or ERP systems? Are logistics teams able to leverage these insights in real time, or is there a lag in decision-making?

Integration is getting better, but it’s still one of the main friction points. Most vision AI systems now come with APIs or middleware connectors that allow for event-based triggers or data sync with WMS/TMS platforms. In more advanced setups, insights like load condition, pallet integrity, or dock activity can trigger real-time alerts or workflow adjustments. But the reality is, unless companies invest in real-time data pipelines and responsive system design, there’s usually some lag. The top performers are treating vision AI as part of their operational nervous system, not just a reporting tool.

7. Beyond efficiency and damage control, what are some of the more unexpected or under-discussed use cases for vision AI in logistics environments?

One that doesn’t get enough airtime is training and workforce optimization. Vision AI can track how new staff handle tasks, where they hesitate, or how their movements compare to seasoned workers—without needing a manager on the floor 24/7. Another is predictive maintenance, not just on conveyors or forklifts, but on dock doors and even racking systems, by detecting wear or structural shifts. Some are even using it to audit sustainability KPIs like waste sorting accuracy or packaging reuse compliance.

8. What’s the biggest myth or misconception about deploying vision AI in logistics operations, and how are successful companies navigating those concerns?

The biggest myth is that you need to boil the ocean on day one, that vision AI must cover every inch of the warehouse before it’s useful. That mindset stalls a lot of good initiatives. In reality, the best ROI often comes from a single, focused deployment, like monitoring outbound lanes for shipping errors or tracking inbound damage rates. From there, momentum builds. Successful teams treat it as a modular journey, not a monolithic rollout.

9. As vision AI becomes more widespread, do you foresee it becoming a new baseline expectation for supply chain visibility, similar to barcode scanning or RFID?

Yes, and in some verticals, it already is. Barcode scanning told us what moved. Vision AI tells us how it moved, when, and in what condition. That level of contextual visibility is becoming table stakes for high-throughput environments. As costs drop and integrations improve, it’ll be hard to justify not having at least basic visual intelligence in the loop, especially when customers and partners start expecting that level of traceability.

10. In terms of compliance, privacy, or worker relations, how are companies addressing concerns around always-on cameras or surveillance in warehouse settings?

This is a growing friction point. The smart ones are being transparent with workers from day one, explaining not just what the cameras are doing, but why. They’re focusing messaging around safety, quality control, and efficiency, not performance policing. Also, privacy-aware implementations are gaining traction, like edge-processing that blurs faces or ignores personally identifiable movements. It’s about creating a perception of augmentation, not surveillance.

11. Is vision AI primarily helping larger, resource-rich companies at this stage, or are there examples of small to mid-sized firms also achieving quick wins with relatively low investment?

While large enterprises are deploying vision AI at scale, smaller organizations are also seeing significant results. Our survey base included around 28% of respondents from companies with fewer than 100 employees and 32% from those with 100–499 employees, and these groups reported efficiency and cost gains at rates comparable to larger peers. Because vision AI can be deployed in targeted pilots that layer onto existing processes, small and mid-sized firms can achieve fast ROI without heavy upfront investment. The decisive factor isn’t budget—it’s choosing expert-aligned solutions over resource-heavy DIY approaches.

12. Looking ahead, how might vision AI evolve in the next 2–3 years, what capabilities are on the horizon that could further reshape warehouse or freight operations?

We’re going to see a big leap in multi-modal AI, where vision is combined with audio, sensor data, and operational metrics to give richer context. Think of a system that doesn’t just see a package fall but understands it was because of excess vibration on a dock plate and auto-generates a maintenance ticket. We’ll also see more edge-native processing, meaning faster insights and less reliance on the cloud. And with generative AI, operators might soon be able to query warehouse events conversationally: “Show me everything unusual that happened on dock 3 last night.” That’s where it’s heading.

Vision AI is moving from optional enhancement to operational necessity. Its value lies in spotting issues and delivering the context, timeliness, and specificity that allow teams to act decisively. As adoption expands, the logistics organizations seeing the strongest returns are those treating vision AI as part of their operational foundation rather than a bolt-on tool. The next wave of capability, combining vision with other sensory and operational data, will require the same disciplined approach to architecture and integration that has defined other breakthrough technologies.

Building vision AI success with Lumenalta

The most effective vision AI programs build from a single proven use case into a system-wide capability that supports continuous improvement. This approach mirrors the way high-performing teams have learned to architect AI agents around memory, ensuring context is preserved and applied where it matters most. By focusing on integration quality, data relevance, and operational fit, leaders can position vision AI to support both immediate objectives and long-term scalability.

At Lumenalta, we partner with CIOs and CTOs to design and implement vision AI systems that meet these exacting standards. Our role extends beyond deployment by ensuring that the intelligence generated is accessible, actionable, and aligned with enterprise goals. This includes helping teams identify high-value starting points, connecting outputs to the systems that drive execution, and building governance practices that maintain accuracy over time. The result is not only better visibility but also a foundation for more responsive, efficient, and resilient logistics operations.